High Court of Kenya Stays Collection of Minimum Tax – Withholding Tax

To print this article, all you need to do is be registered or log in…

To print this article, all you need to do is be registered or log in…

November 22, 2021 Anjarwalla and Khanna To print this article, all you need…

[ad_1] The current version of the reconciliation bill, the Build Back Better Act, attempts to…

[ad_1] The Build Back Better Act (BBBA) would increase taxes to pay for social spending…

[ad_1]The inclusion of tax-exempt income in a proposed federal alternative minimum corporate tax bill in…

[ad_1] By Ramon Bonell, EURTAX.com, Madrid Spain’s 2022 budget establishes a minimum corporate tax rate…

[ad_1]ISLAMABAD: The Lahore High Court (LHC) issued notices of contempt of the Federal Board of…

By Doug Connolly, MNE Tax OECD tax policy director Pascal Saint-Amans in a Nov. 4…

[ad_1] The latest version of the Biden administration’s Build Back Better reconciliation program reintroduces a…

[ad_1] Democrats are considering extending the minimum tax rates that some high earners will have…

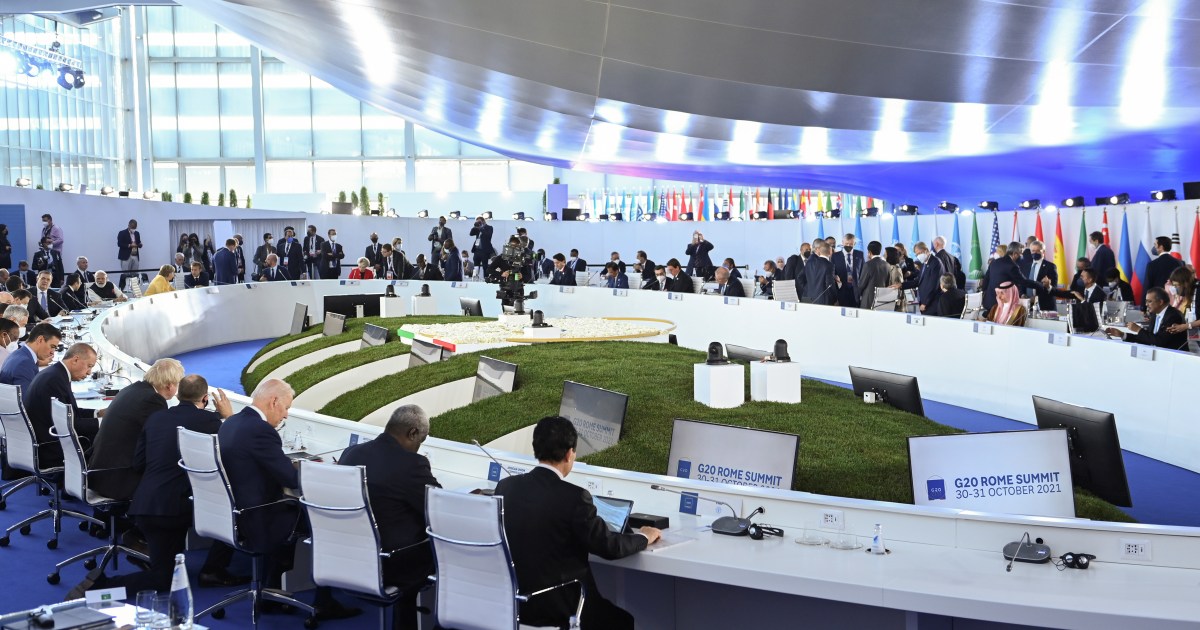

ROME – One of the takeaways from the recent G20 summit in Rome is the…

[ad_1] The minimum corporate tax included in the budget reconciliation bill would create undue complexity…

[ad_1] On Tuesday evening, Senate Finance Committee Chairman Ron Wyden (D-OR) and Senses Angus King…

The G20 endorsed the two-pillar proposal of the OECD Inclusive Framework (IF) an overall minimum…

[ad_1]The leaders of the world’s 20 largest economies have approved a 15% global minimum tax…

[ad_1]Leaders of the world’s largest economies on Saturday approved a global minimum corporate tax as…

[ad_1] Kenya and Nigeria have pulled out of a global tax reform plan that prevents…

Leaders of the world’s largest economies endorse the establishment of a global minimum tax at…

A happy start for President Biden at the G20 summit in Rome on Saturday. Photo:…

[ad_1] On October 26, 2021, Senators Elizabeth Warren (D-MA), Angus King (I-ME) and Ron Wyden…

[ad_1] Tax reform should simplify the tax code. Instead, Congress is debating new ways to…

[ad_1] By Doug Connolly, Multinational Corporate Taxation Update October 28, 2021: Framework released. Confirms 15%…

Given accounting differences between global insurance companies in different jurisdictions, a new global minimum tax…

[ad_1]Senator Kyrsten SinemaKyrsten Sinema With extreme gerrymanders locked down, Biden must make preserving democracy a…

[ad_1] One of the ways that employees can be compensated for their work, in addition…

[ad_1]The net profitability gap between companies incorporated in Bermuda and non-Bermuda may narrow over time…

WASHINGTON (Reuters) – President Joe Biden will meet Pope Francis on October 29 before attending…

[ad_1]By Christian KraemerWASHINGTON, Oct. 13 (Reuters) – Germany can expect to raise an additional €…

[ad_1] G-20 finance ministers are due to meet in Washington today to discuss the 15%…

[ad_1]A new global deal to levy a near-universal 15% minimum tax on corporate profits could…

[ad_1] US Treasury Secretary Janet Yellen, pictured on October 6, 2021 in the White House,…

Economics teachers like to have a fun competition with their students to introduce them to…

[ad_1] Treasury Secretary Janet Yellen said yesterday she was confident the U.S. Congress would approve…

[ad_1] The parliamentary maneuver known as budget reconciliation would allow Democrats to act without Republican…

[ad_1] Many of the world’s most powerful nations came together on Friday with the intention…

[ad_1] Nearly 140 countries reach agreement on corporate minimum taxThe deal announced on Friday calls…

[ad_1] To note: This article was originally published on July 1, 2021, but has been…

/cloudfront-us-east-2.images.arcpublishing.com/reuters/GACRZYOSLBJNFNRMZRY2IFO6PA.jpg)

People walk through the financial and business district of La Defense in Puteaux near Paris,…

[ad_1] Foreign Affairs and Trade Minister Péter Szijjártó met his American counterpart Antony Blinken in…

Global minimum tax is in final stages of finalization, Finance Minister Nirmala Sitharaman saysIndia is…

Finance Minister Nirmala Sitharaman said on Wednesday that India was “very close” to getting to…

[ad_1]PARIS – An updated plan for a global corporate tax overhaul has dropped “at least”…

[ad_1] Kenyan taxpayers are not yet out of the woods, even after the minimum tax…

[ad_1] Â Launch U.S. International Tax Reform Resource Center Key Findings The political effort to…

[ad_1] TEMPO.CO, Jakarta – Finance Minister Sri Mulyani Indrawati said the government would set the…

[ad_1] By Dr. Monika Laskowska, Center for Tax Analysis and Studies, Warsaw School of Economics…

[ad_1] On Tuesday, the US Treasury Department published a blog written by Treasury officials Itai…

[ad_1] Breadcrumb Links New PF comment Election 2021 Liberal proposal could deny donation credits to…

[ad_1] While the Liberals had previously announced housing and profit taxation policies for large financial…

The potential impact of proposed global minimum tax rates remains difficult to assess, according to…

[ad_1] Correction (08/25/2021): Due to a minor error in our multinational tax model, many of…

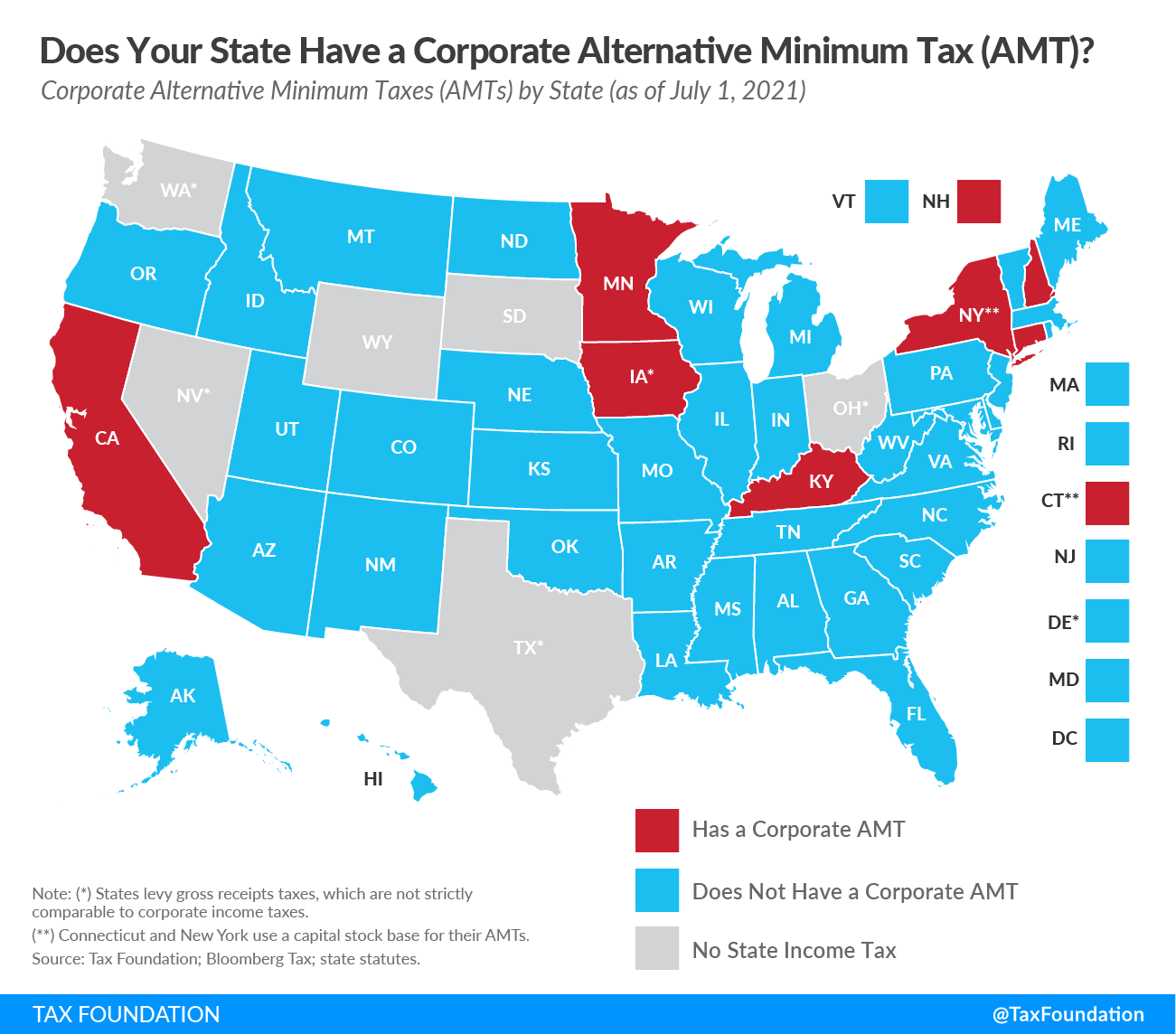

[ad_1] This week’s map shows the five states that have an alternative minimum tax (AMT)…

[ad_1] The OECD has been working on a package of proposals to deal with tax…

[ad_1] By Raman Ohri, Head of Direct Taxation, Keypoint, Bahrain The July 1 inclusive framework…

[ad_1] Hungary refuses to give up its financial sovereignty by introducing a global minimum corporate…

This week’s map shows states that levy alternative minimum taxes (AMTs) to prevent corporations from…

[ad_1]Senator Elizabeth Warren of Massachusetts and her allies will propose a minimum tax on the…

[ad_1]Here’s what you need to know:VideotranscriptBacktranscriptG7 Initiatives Aim to Counter China’s Influence, Biden SaysAfter the…

[ad_1] By Doug Connolly, Multinational Corporate Taxation EU Tax Observatory July 21 study predicts that…

[ad_1] M Rifqy Nurfauzan Abdillah and Pungki Yunita Chandrasari (The Jakarta Post) PREMIUM Jakarta â—…

[ad_1] Biden and world leaders at the G-7 summit reach agreement on a global minimum…

[ad_1]President BidenJoe BidenBiden appoints Mark Brzezinski US Ambassador to Poland 10 dead after overloaded van…

President Biden has proposed a minimum corporate tax of 15%. Has he forgotten that the…

[ad_1] In Venice, the finance ministers of the G-20 countries supported the historic tax agreement…

[ad_1] US Treasury Secretary Janet Yellen said Thursday she was “not sure” whether Amazon will…

[ad_1]An effective MTR will lead to increased tax costs for multinational groups that are currently…

[ad_1]Regime targeting large multinationals that do not pay their fair share to replace the digital…

/bonds-lrg-4-5bfc2b234cedfd0026c104ea.jpg)

[ad_1] Did you know that you are supposed to calculate your taxes in two different…

[ad_1] By Doug Connolly, Multinational Corporate Taxation The seven countries that have yet to sign…

Program targeted at large multinationals not paying their fair share to replace the Digital Services…

[ad_1] Fox News collaborator Liz Peek and economist Steve Moore discuss U.S. tax rates on…

Friday July 09, 2021 / 09:19 / By CITN / Header image credit: bbc Overview…

[ad_1]WASHINGTON — When the United States won international support for a global minimum corporate tax…

[ad_1] Senator Pat Toomey, R-Penn., Calls secretary’s plan a “terrible deal” on “Kudlow” Treasury Secretary…

[ad_1] President Joe Biden holds a press conference at the end of the G7 summit…

[ad_1] Former Wisconsin congressman Sean Duffy and Payne Capital Management chairman Ryan Payne discuss a…

[ad_1] Nine countries have refused to sign a framework for international tax reform that includes…

[ad_1] A group of 130 countries struck a groundbreaking deal last week for a global…

[ad_1]The 15% minimum corporate tax rate agreed Thursday by 130 countries will have a limited…

[ad_1] Two-thirds of the world’s largest companies paying less than 15% effective tax are based…

[ad_1] Some 130 countries have supported a global minimum tax as part of a global…

[ad_1]Scott, let’s start with the basics. What do we know about 0micron, and what don’t…

[ad_1] By Vasiliki Koukoulioti, doctoral researcher at Queen Mary University in London The agreement on…

[ad_1] By Doug Connolly, Multinational Corporate Tax A draft statement for the next G20 finance…

[ad_1] Recent discussions over a global minimum tax may lead many to believe that there…

[ad_1]On June 5, G7 finance ministers agreed on global tax reforms that would grant taxing…

ISLAMABAD: The Federal Board of Revenue (FBR) clarified on Sunday that the table prescribing minimum…

Irish Finance Minister Paschal Donohoe said on Friday he believed countries should work to reach…

[ad_1] While we don’t know when the Covid-19 pandemic will be over, international tax rules…

[ad_1] By Doug Connolly, Multinational Corporate Taxation The European Commission will propose legislation to implement…