The Constitution of India has created three pillars of democratic India – Legislature, Administrator and Judiciary and each of them having its independent role. The primary role of the judiciary is to administer justice, including interpreting laws enacted by the legislature. One can understand the importance of interpretation enshrined in the Constitution of India which, an entire separate wing is there for interpretation.

Interpretation is a process by which one expounds the law. There are various rules of interpretation that are used by the judiciary to decide a particular issue. Rules of interpretation are a crucial tool for understanding the true meaning of the law and for refining the best possible interpretation of the law. The rules of interpretation also apply to the interpretation of tax law and it is necessary to apply the correct rule of interpretation to arrive at the applicability of a particular provision of tax law.

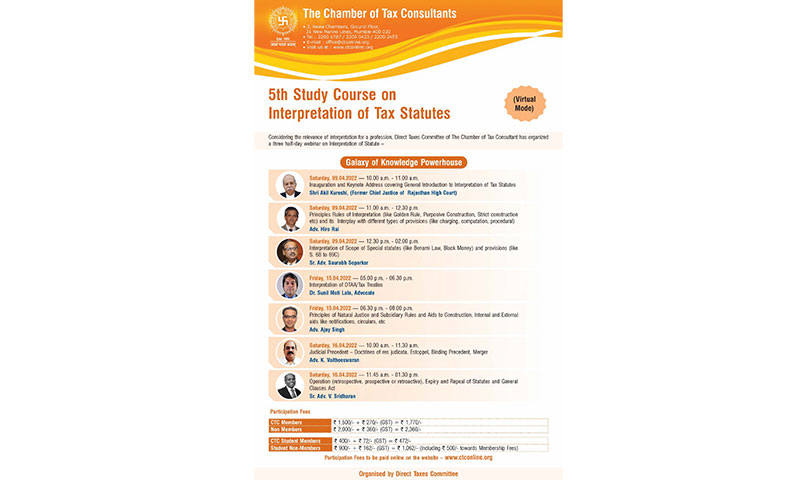

Considering the relevance of interpretation for a profession, the Chamber of Tax Advisors organized a three half-day webinar on the interpretation of laws –

|

Sr. No. |

Day, date and time |

Topics |

The faculties |

|

1 |

Saturday, 10:00 a.m. – |

Inauguration and keynote speech covering the general introduction to the interpretation of tax laws |

Shri Akil Kureshi, |

|

2 |

Saturday, 11:00 – |

Principles Rules of interpretation (such as golden rule, purposive construction, strict construction, etc.) and its interaction with different types of provisions (such as billing, calculation, procedure) |

Adv. Hiro Rai |

|

3 |

Saturday, 12:30 p.m. – |

Interpreting the scope of special laws (such as the Benami Law, Black Money) and provisions (such as S. 68 to 69C) |

Sr Adv Saurabh Soparkar |

|

4 |

Friday, 5:00 p.m. – |

Interpretation of DTAAs/Tax Treaties |

Dr. Sunil Moti Lala, Attorney |

|

5 |

Friday, 6:30 p.m. – |

Principles of natural justice and subsidiary rules and construction aids, internal and external aids such as notices, circulars, etc. |

Adv. Ajay Sing |

|

6 |

Saturday, 10:00 a.m. – |

Judicial precedent – Doctrines of res judicata, estoppel, binding precedent, merger |

Adv. K Vaitheeswaran |

|

7 |

Saturday, 11:45 a.m. – |

Law on the application (retrospective, prospective or retroactive), expiry and repeal of laws and general clauses |

Sr Adv. V.Sridharan |

Participation fee

CTC Members:-Rs. 1,500/- + rupees. 270/- (GST) = Rs. 1,770/-

Non-members:-Rs. 2,000/- + rupees. 360/- (GST) = Rs. 2,360/-

CLC Student Members:-Rs. 400/- + rupees. 72/- (GST) = Rs.472/-

Non-member students: –Rs. 900/- + Rs. 162/- (GST) = Rs.1,062/-

(Including Rs. 500/- for membership fees) –

Note:- Please complete the Student Membership Form:- Click here & make payment via NEFT (Click here)

Participation fees to be paid online on the site: CLICK HERE make a payment

For more details, please visit our website – www.ctconline.org