[ad_1]

The Internal Revenue Service and the Treasury Department sent the fifth round of child tax credit advance payments to millions of American families on Monday.

Families can receive up to $ 300 per month for each child under 6 and up to $ 250 per month for each child 6 to 17. Payments began July 15 and will continue on the 15th of each month until December.

The payments are part of an extension of the child tax credit as part of President Joe Biden’s US bailout. The payments are an advance on a portion of the child tax credit that eligible individuals will be able to claim on their 2022 tax refund. In total, eligible families are expected to receive $ 3,000 to $ 3,600 per child, according to the White House.

Who is entitled to the tax credit?

Families are eligible for the full child tax credit if they earn up to $ 150,000 as a couple or $ 112,500 as a single parent. Eligible children must be under the age of 18 at the end of 2021.

Most eligible people don’t have to do anything to start receiving their payments if they claimed the child tax credit on their 2019 or 2020 income tax returns.

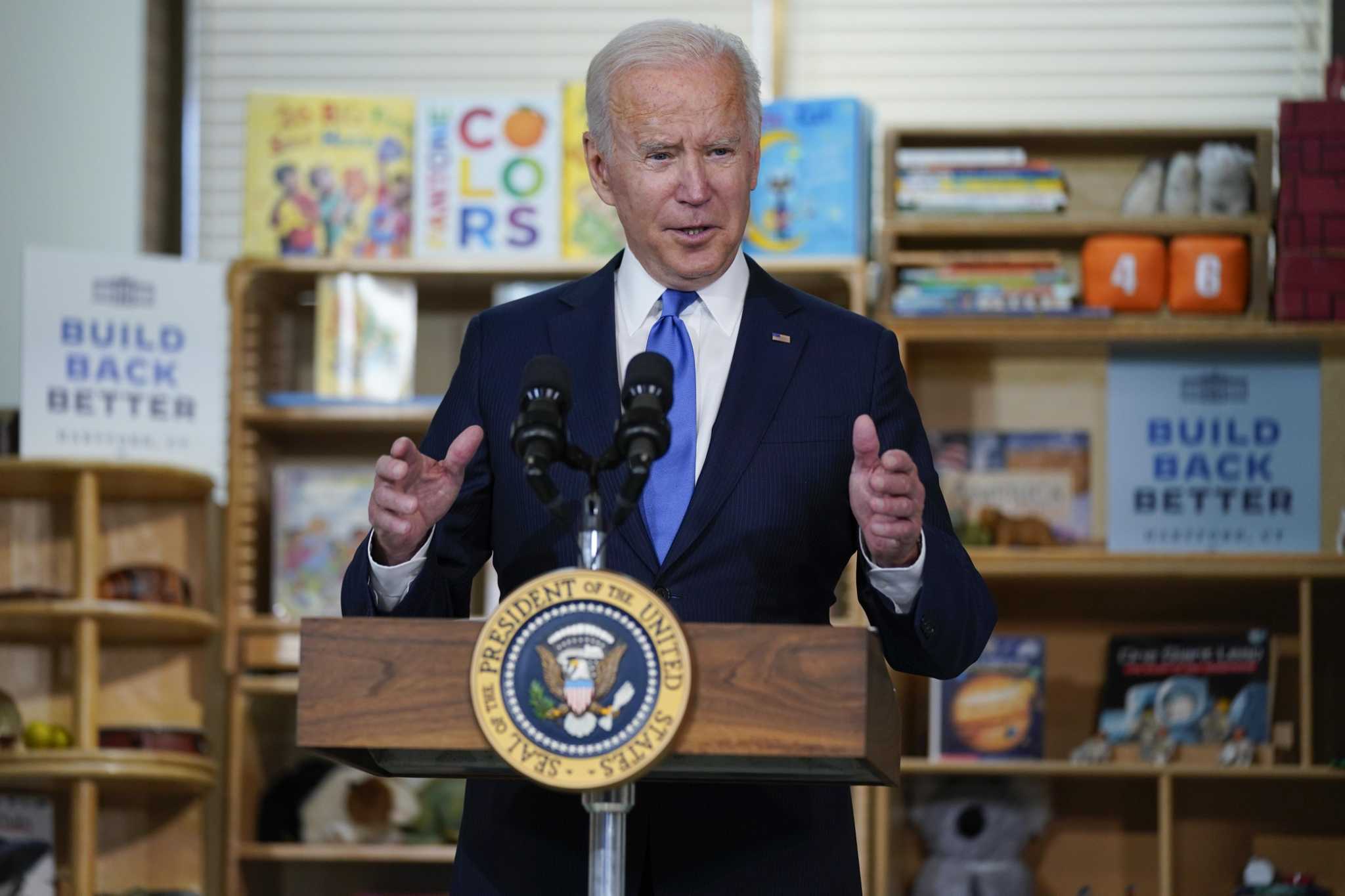

Biden has called for extended child tax credits to continue under his social services legislation. Democrats lowered the spending bill after moderate party members objected to the high price tag of Biden’s original proposal, but the smaller $ 1.85 trillion proposal would still see a one-year credit extension expanded child tax, according to the Associated Press reported.

Biden highlighted the social spending proposal, known as “Build Back Better,” during a visit to Connecticut last month, while reiterating calls for the nation’s wealthiest to pay more taxes.

How do you get the money?

In most cases, people should see the money deposited into the bank account they used to file their taxes for 2019 or 2020, or to receive a stimulus check.

Those who had not declared their taxes had until Monday to subscribe to monthly payments via a non-file tool. Families who missed the deadline will still be able to claim the full child tax credit when they do their taxes in 2022.

People eligible for the credit can also opt out of advance payments to claim the full credit on their tax return next year. Theirs has a portal which allows eligible people to opt out of prepayments, change their address and bank account information, and other options.

Those receiving paper check payments should expect it to take a little longer to arrive – expect to see the checks by the end of the month. For people who have already received their payments in the mail and wish to switch to direct deposit, it is still possible to do so via the payment portal. Recipients must complete their payment method adjustment by 11:59 p.m. on November 29.

[ad_2]