[ad_1]

Recent discussions over a global minimum tax may lead many to believe that there is only one proposal being discussed for the world. This is not the case.

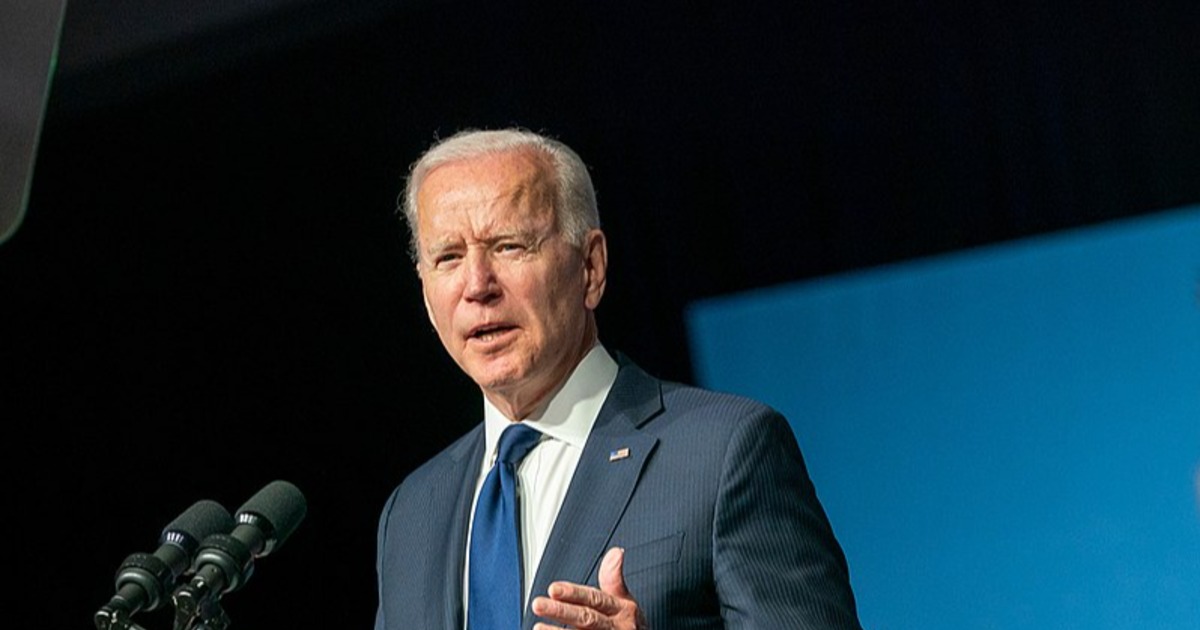

While President Biden has led a renewed effort on global minimum tax negotiations, his own proposals for American businesses differ significantly from proposals that had previously been discussed internationally. In fact, if other countries implement a policy like it was described last year, Biden’s proposal would be a much heavier policy for American companies than what other countries might adopt.

Details on the structure of a global minimum tax are not yet finalized. However, it’s worth comparing Biden’s proposals for taxing the foreign profits of U.S. companies with the recent agreement for a 15% global minimum tax backed by 130 countries and jurisdictions and the Cooperation Organization’s blueprint. and economic development that preceded it.

The table below reviews some features of Biden’s proposals to change Global Intangible Low-Tax Income (GILTI), which is the US version of a minimum tax on foreign profits of US corporations. These characteristics are compared to what the global minimum tax could be based on the recent agreement and an OECD blueprint released last October.

| Minimum tax proposed by President Biden for US corporations | Global minimum tax overview | |

|---|---|---|

| Rate | 21% (could be 26.25% or more depending on foreign tax exposure and distortions for expense deductions). | 15% (July 1, 2021 agreement) |

| Exclusion for normal return on tangible assets | No (would cancel an existing deduction of 10%) | Yes, 7.5% for the first five years, 5% thereafter (agreement of July 1, 2021) |

| Exclusion for a normal return on labor costs | No | Yes, 7.5% for the first five years, 5% thereafter (agreement of July 1, 2021) |

| Loss reports | No | Yes (OECD plan) |

| Foreign tax treatment | Credit for 80% of foreign taxes paid, no carry-over for excess credits | Full credit and carry-over of surplus to future years (OECD master plan) |

| Jurisdictional calculation | Country by country | Country by country (OECD plan) |

| Income threshold | Nothing | 750 million euros (agreement of July 1, 2021) |

| Definition of income | Foreign taxable income as defined in the Internal Revenue Code | Financial profits as defined by accounting standards and adjusted to approximate taxable profits |

|

Sources: United States Department of the Treasury, “General Explanations of the Administration’s Fiscal Year 2022 Revenue Proposals,†May 2021, https://home.treasury.gov/system/files/131/General- Explanations-FY2022.pdf; G7, “Communiqué from the G7 Finance Ministers and Central Bank Governors,†June 5, 2021, https://home.treasury.gov/news/press-releases/jy0215; OECD, “Tax Challenges Arising from Digitization – Pillar 2 Blueprint Reportâ€, Inclusive Framework on BEPS, October 14, 2020, https://www.oecd.org/tax/beps/tax-challenges-arising-from -digitalisation -report-on-pillar-two-blueprint-abb4c3d1-en.htm. |

||

First of all, the tax rate differs. Current US law requires companies to pay taxes on GILTI; tax rates vary depending on the amount of foreign taxes a business owes. Rates can be as low as 10.5-13.125 percent, but can be considerably higher due to US tax credit and expense allocation rules.

President Biden is proposing a foreign income tax rate of 21%, which could result in an effective rate of 26.25% or more due to the tax credit and foreign expense allocation rules.

As the 130 countries recently agreed, the global minimum tax rate would be at least 15%.

Second is the treatment of property, plant and equipment. Companies have foreign assets like factories and distribution centers for various reasons. Sometimes they have to manufacture their products close to their consumers or they have to locate near natural resources.

Biden proposes to eliminate a 10 percent deduction for these tangible assets, essentially increasing the tax costs of a U.S. company that might want to enter a new market and reach more foreign customers. The 10% deduction was intended to exclude a normal rate of return on GILTI’s assets.

The global agreement provides for a 7.5% deduction for foreign tangible assets. After five years, this percentage would be reduced to 5 percent.

Third is the treatment of labor costs. Biden does not offer a deduction for foreign wage costs, but the recent agreement provides for a 7.5% deduction for wage costs that would be reduced to 5% after five years.

Fourth is the treatment of losses. It is generally good tax policy to allow companies to deduct losses from profits. This avoids a volatile tax bill for businesses and recognizes the expensive start-up phase for new businesses.

Biden does not offer any loss carry forward in his minimum tax approach. This contrasts with the OECD master plan in October, which provides for loss compensation.

Fifth is the treatment of foreign taxes. Current US law limits foreign tax credits to 80% of their value when calculating taxes owed on GILTI. This means that the nominal tax rate on GILTI can be 13.125% or more. Biden has not proposed changing the 80% limit on foreign tax credits, so GILTI’s tax rate could be 26.25% or more if companies are exposed to high foreign taxes.

GILTI’s current policy also prevents companies from carrying over excess foreign tax credits into future years. This creates volatility in the GILTI bond if a company has a significant foreign tax burden in one year but cannot use additional tax credits to offset the GILTI bond in future years.

The OECD project provided for full credibility for foreign income taxes and the ability to use excess tax credits in coming years to smooth out tax liability over time.

The sixth item to compare the two approaches shows the only place where there is some commonality. Biden proposed to calculate the GILTI for each country where a company operates. This would represent a significant change from GILTI’s current policy, which allows companies to mix their foreign income into a single pool before calculating the additional US tax payable.

However, the calculation at the country level is in line with the OECD jurisdictional approach, which was discussed in the master plan.

A seventh element is whether an income threshold applies. In current GILTI law and in Biden’s proposal, there is no income threshold that applies before a business can have to calculate an additional US tax liability. However, the agreement signed by 130 countries suggested using a revenue threshold of 750 million euros (893 million US dollars) to target the global minimum tax on the largest companies.

a eighth The way to compare the two approaches is how they define taxable income. GILTI is part of the Internal Revenue Code of the United States and applies to a definition of foreign income defined by Congress. However, the OECD blueprint suggests defining revenues on the basis of financial statements, such as those declared to shareholders of state-owned enterprises. This would likely be done at the corporate group level, taking into account the financial data of the global entity.

The OECD recommends making several adjustments to financial profits, but there would be significant reliance on financial accounting rules rather than statutory tax legislation to define income.

Biden’s proposals to change GILTI are important, as are discussions over a global minimum tax. However, the comparison of policy outlines shows that Biden is proposing a set of tax rules that are more onerous for US multinationals than what has been discussed at the OECD. The United States has been in those conversations and supports the deal, but it’s unclear how this will influence Biden’s agenda in Congress.

If the Biden approach to GILTI is taken while the rest of the world takes a lighter form of global minimum tax, it will have significant ramifications for US companies, making them less competitive compared to their foreign peers.

As policymakers debate changes to GILTI and the design of the global minimum tax, it is important to keep these differences in mind as well as the potential impact of the policy design on investment decisions. cross-border.

Note: This article was updated on July 2 to reflect the most recent details of the OECD agreements.

Launch the U.S. International Tax Reform Resource Center

Was this page useful for you?

Thank you!

The Tax Foundation works hard to provide insightful analysis of tax policy. Our work depends on the support of members of the public like you. Would you consider contributing to our work?

Contribute to the Tax Foundation

Let us know how we can better serve you!

We are working hard to make our analysis as useful as possible. Would you consider telling us more about how we can do better?

Give us your feedback

[ad_2]