[ad_1]

AUGUSTA, Maine – More than 50 years after Maine first instituted a state income tax, former Gov. Paul LePage is calling for its elimination as he runs for a third term next year.

The former two-term governor officially kicked off his campaign this week after applying for a third term earlier this summer. He seeks to overthrow Governor Janet Mills, a Democrat who has sought to undo much of her legacy on issues such as Medicaid and the size of state government, but has left her tax cuts in place despite the objections of progressives.

Efforts to reform Maine’s personal income tax are not new, and they haven’t always followed partisan lines. Maine first passed a personal income tax on a bipartite basis in 1969. More recently, Democrats attempted to move Maine to a substantially flat tax rate a little over two years ago. ‘a decade, but the change was rejected by Republicans who managed to veto the people.

LePage was successful in lowering tax rates in Maine as governor, but made little progress in his goal of eliminating personal income tax, as even Republicans in the legislature were skeptical. The historic debate provides insight into the main hurdles LePage could face if he wins the Blaine House and tries to eliminate the tax.

The origins of Maine income tax

The Maine legislature envisioned a state income tax over a century ago, even going so far as to propose an amendment to the state’s constitution, but it failed via a referendum in 1920. The Republican-led legislature envisioned a personal income tax 30 years later, but instead chose to pass Maine’s first sales tax in 1951.

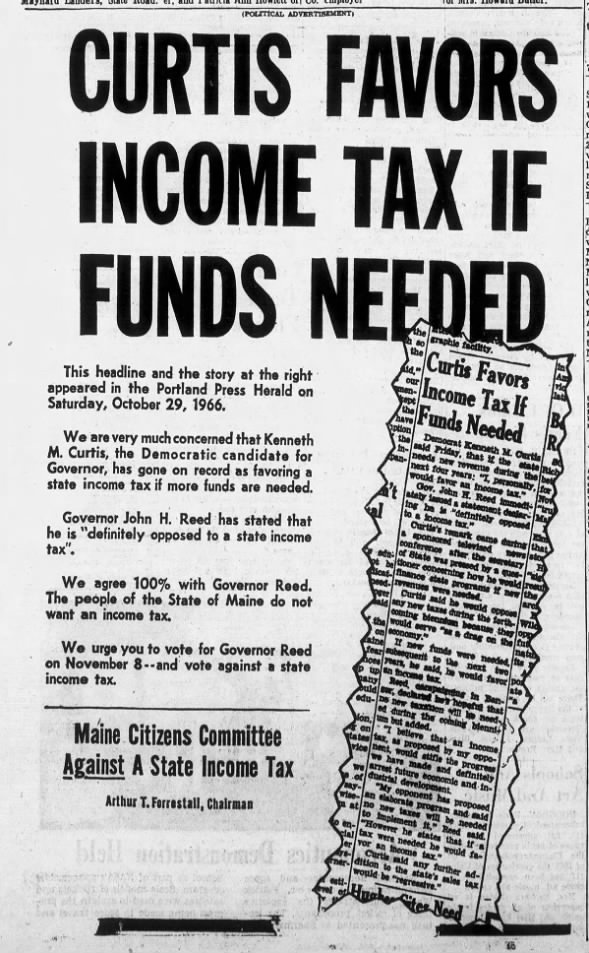

The idea caught on in the 1960s as lawmakers sought additional sources of revenue, and it became an issue in the 1966 gubernatorial race between incumbent Gov. John Reed, an opposing Republican. to income tax, and then Secretary of State Ken Curtis, a Democrat who said he would favor it as a mechanism to increase much-needed income.

Political curtis add 1966 08 Nov 1966, Tue The Bangor Daily News (Bangor, Maine) Journaux.com

Curtis won the election by six points and remains to this day the last challenger to overthrow an incumbent governor of Maine. The legislature debated income tax again in 1967, but lawmakers were skeptical, citing the administrative cost of a new tax, as well as fears it might cause workers to leave the state, according to Bangor Daily News archives. The effort failed, with only a handful of Democrats voting in favor.

“There is no such thing as a fair tax,” Senate Minority Leader Floyd Harding, D-Presque Isle, who favored the measure, said after it failed. “It comes down to a question of what people will tolerate. “

But concerns about state revenues and tight municipal budgets forced lawmakers to reconsider income tax in the next legislative session. In March 1969, a University of Maine professor warned the Legislative Assembly Tax Committee that local property taxes could double over the next decade without increased state financial assistance.

Supporters have presented income tax as an alternative to increasing other taxes. They argued that it was fairer than a sales tax because it would have less of an effect on low-income people and retirees, according to a Bangor Daily News article at the time, and that it would be more responsive to economic growth, producing more income without increasing tariffs.

Passing such a tax would require bipartisan support, as both houses of the Legislature were controlled by Republicans. But lawmakers eventually came to a consensus and passed the state of Maine’s first income tax in 1969, implementing a tiered system with a top marginal rate of 6%. The corporate tax was also enacted that year.

Political onlookers predicted the new tax would be unpopular, but Curtis was re-elected anyway in 1970. A year later, opponents of the tax gathered enough signatures for a vote to repeal it. But the referendum failed in November 1971 by 75-25.

More recent changes

The Legislature has continued to make personal income tax changes over the years, adjusting tax brackets and increasing the top marginal rate to 8.5 percent. A Democratic legislature under former Governor John Baldacci passed legislation in 2009 to create a flat-rate 6.5 percent income tax, except for a surtax on people earning more than $ 250,000.

The change was to be paid for by extending the sales tax to more services and increasing the tax on food and lodging, a provision that prompted a significant setback from much of the business community in the state.

Opponents launched a popular veto challenge and in June 2010 they succeeded, with 61% of voters voting to cancel it. Republicans used this momentum to regain control of the Legislature later that year, when LePage was first elected governor.

LePage and the Legislature ultimately lowered the top marginal tax rate from 8.5% to 7.15% in 2011. And four years later, barely re-elected, the Republican governor proposed another round of Income tax cuts offset in part by extending sales tax to more goods and services. He said he was working to phase out personal income tax over five years. But his plan was met with skepticism by Republicans and Democrats, and LePage’s suggested constitutional amendment to eliminate income tax was never passed.

Even with the tax cuts of the LePage era, personal income tax still generates more income than any other source in Maine. For the state’s current fiscal year, it is expected to account for about 44% of all non-dedicated state revenue, or about $ 1.8 billion.

Efforts to eliminate it in the coming years will face the same problem that lawmakers have debated for more than 50 years – finding another way to increase income.

More articles from the BDN

[ad_2]